|

| Image credit |

Enjoy and practice your French:

Attempts at Liberty — Versuche über die Freiheit __________________________________________________________ A Bilingual Blog / Ein zweisprachiger Blog

|

| Image credit |

|

| Image credit |

In this blog post – The full employment fiscal deficit condition (April 13, 2011) – which I consider to be core MMT, I showed the conditions that determine the fiscal deficit, once the government assumes its responsibility to achieve and sustain full employment.

The lessons, in summary are

1. A macroeconomy is in a steady-state (that is, at rest or in equilibrium) when the sum of the injections equals the sum of the leakages. The point is that whenever this relationship is disturbed (by a change in the level of injections, however sourced), national income adjusts and brings the income-sensitive spending drains into line with the new level of injections. At that point the system is at rest.

2. The injections come from export spending, investment spending (capital formation) and government spending.

3. The leakages are household saving, taxation and import spending.

4. An economy at rest is not necessarily one that coincides with full employment.

5. When an economy is ‘at rest’ and there is high unemployment, there must be a spending gap given that mass unemployment is the result of deficient demand (in relation to the spending required to provide enough jobs overall).

6. If there is no dynamic which would lead to an increase in private (or non-government) spending then the only way the economy will increase its level of activity is if there is increased net government spending – this means that the injection via increasing government spending (G) has to more than offset the increased drain (leakage) coming from taxation revenue (T).

So in sectoral balance parlance, the following rule hold.

To sustain full employment the condition for stable national income defines what I named the [f]ull-employment fiscal deficit condition:

(G – T) = S(Yf) + M(Yf) – I(Yf) – X

The sum of the terms S(Yf) and M(Yf) represent drains on aggregate demand when the economy is at full employment and the sum of the terms I(Yf) and X represents spending injections at full employment.

If the drains outweigh the injections then for national income to remain stable, there has to be a fiscal deficit (G – T) sufficient to offset that gap in aggregate demand.

If the fiscal deficit is not sufficient, then national income will fall and full employment will be lost. If the government tries to expand the fiscal deficit beyond the full employment limit (G – T)(Yf) then nominal spending will outstrip the capacity of the economy to respond by increasing real output and while income will rise it will be all due to price effects (that is, inflation would occur).

What that means in relation to the issues I identified above is that there is a difficulty in defining pro-cyclicality in terms of a given fiscal balance.

It is nonsensical to say a fiscal surplus is always pro-cyclical and a deficit is always counter-cyclical. It all depends on the spending and saving patterns of the non-government sector.

We can only really appraise the impact of the fiscal balance in terms of changes at specific points in the cycle.

So if an economy was at full employment and the fiscal deficit was, say 2 per cent of GDP and that satisfied the condition specified above.

That is not a pro-cyclical position even if the economy is growing – it is maintaining a steady-state growth path.

Should the government, with no other changes evident, increase its net spending to say 3 per cent of GDP, under those circumstances, we might consider that a pro-cyclical policy change because it is pushing the cycle beyond its full employment steady-state growth path.

So the fact there is a fiscal deficit coinciding with strong GDP growth should not be taken as a case of irresponsible and dangerous policy.

What about running surpluses when recovery is apparent?

The same logic holds. It might be that the non-government spending and saving decisions drive overall spending so fast that total spending then starts to outstrip capacity.

Then, to restore the full employment steady-state (and this also requires stable inflation), the fiscal stance has to [be] contractionary – which might require a fiscal surplus.

For example, nations such as Norway will typically solve the [f]ull-employment fiscal deficit condition with a fiscal surplus given how strong their external sector is (energy resources).

|

| Image credit |

Verfügen die Menschen über wenig Geld, geben sie auch dementsprechend wenig aus.

Die Hauptauslöser für die anhaltend niedrige Inflation im Euroraum sind niedrige Löhne, unsichere Arbeitsplätze und der EU-Kult der rigorosen Sparmassnahmen (namentlich fiscal austerity).

Es ist ein offenes Geheimnis, dass die unpopulären angebotspolitischen Patentrezepte der im Euroraum vorherrschenden neoliberalen Agenda angesichts einer strikten Haushaltskonsolidierung zu Lohnkürzungen und zum Rückbau von Sozialleistungen führen.

Eine „schwarze Null“ als haushaltspolitisches Ziel pflegt das Mantra „sparen über investieren“.

Quelle.

|

| Image credit |

|

| Image credit |

1. Is it possible that inflation exists but it shows up mainly in financial assets (stocks, bonds, perhaps real estate) that don't really factor into standard inflation metrics? Every step the Fed has taken, as well as other western central banks, appears to me to be crafted to pump money into securities markets rather than into main street. Certainly we have seen a huge inflation in the value of financial assets and real estate over the past several years.

2. Expansion of the economy above the rate of productivity improvement should drive inflation, unless there was a lot of excess capacity to soak up. That may have been partly the case in the US since 2008, but surely that is gone. Does the still greatly underutilized Chinese and Indian labor force act as excess capacity that prevents inflation from heating up here? If so, might Trump's trade restrictions interfere with this going forward?

First, the two examples – the helicopter drop and electronically crediting peoples’ private bank accounts with new deposits are not equivalent events. But that is a small issue.

Second, neither will necessarily cause the price level to accelerate more quickly (that is, increase inflation).

Why not? What if all the cash from the helicopters fell into the fields and stayed there?

What if the bank customers, fearing future unemployment and the income uncertainty that accompanies that fear, decided to build saving deposits up further and considered the electronic crediting of their accounts to be a boost to that effort.

In either case, there will be no price level effects of the central bank operation.

If, the bank customers took all the increased deposits provided by this central bank operation and used the funds to purchase TVs, food, cars, holidays etc – that is, real goods and services then there is the possibility of accelerating inflation.

If there is idle capacity in the economy and firms who supply TVs, food, cars, etc have the capacity to supply those goods and services then they will defend their market share by increasing output and sales at the current price levels on offer. Firms typically ‘quantity-adjust’ rather than ‘price-adjust’ when there is excess (idle) capacity. Otherwise, they risk losing market share.

So in that case there will be no acceleration in inflation. The increased spending will generate a positive output and employment response and the nation will enjoy higher real incomes.

The possibility of inflation will only become a reality, if the bank customers start liquidating the increased deposits through increased expenditure and the economy is incapable of meeting that increased growth in nominal spending through increased output.

When firms can no longer ‘quantity-adjust’ they ‘price-adjust’.

So it is not a self-evident truism that central banks can always increase the inflation rate.

|

| Image credit |

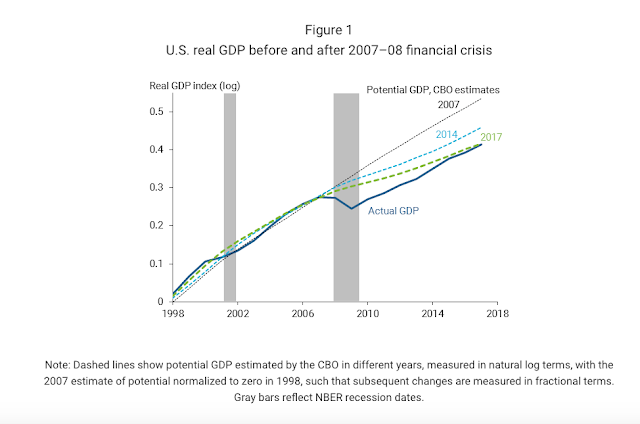

einem lebenslangen Barwertverlust (present value) von etwa sage und schreibe 70‘000 USD für jede/n Amerikanerin/Amerikaner.

|

| Image credit |

Die Höhe der Verluste deutet darauf hin, dass das Produktionsniveau voraussichtlich nicht auf das Vorkrisenniveau zurückkehren wird, lautet das Resümee der Forschungsarbeit.

...

Fazit: anhaltende Widrigkeiten am Finanzmarkt können erhebliche soziale Kosten verursachen, da sie das BIP nachhaltig beeinträchtigen.

Dies deutet darauf hin, dass die Suche nach Möglichkeiten zur Verhinderung oder Eindämmung künftiger Finanzkrisen eine wichtige Priorität für Forschung und Politik darstellen muss.

Doch es gilt nüchtern festzuhalten, dass die neoklassische Wirtschaftspolitik, die ja in den grössten Volkswirtschaften kontinuierlich den Ton angibt, weiterhin an manchen überholten doktrinären Grundsätzen festhält.

Der Einsatz der Fiskalpolitik ist beispielsweise irgendwie immer noch ein Tabu, trotz der Tatsache, dass der Unternehmenssektor in Deutschland, Italien, Japan, Grossbritannien und den USA inzwischen zum Netto-Sparer wurde und in z.B. Europa eine nicht unerhebliche Investitionslücke besteht, was hohe Unterbeschäftigung und prekäreArbeitsverhältnisse nach sich zieht.

|

| Image credit |

... we now need to show that we can be sustainably profitable.

We will not achieve our mission of advancing sustainable energy unless we are also financially sustainable.

To summarize: the company would like its investors - who are "extremely important" to Musk - to believe that within three weeks, it first had "secured funding", then hired advisors, then reviewed a potential transaction, then got a subpoena from the SEC, then carefully explored all potential avenues and then, as a group, arrived at the conclusion that it would be better off staying public.

While nobody in the investing will believe that, what matters now is what the regulators believe, and alternatively, what they decide is fraud.

As for Tesla, just days after the going private transaction, we predicted that "TSLA will be that one stock that sees class actions suits by both shorts and longs."

The shorts have already started suing, claiming Musk defrauded them via glaring market manipulation. Now it's time for the longs to join.

|

| Image credit |

|

| Image credit |

Having gone through a handful of the most frequently used textbooks of economics at the undergraduate level today, I can only conclude that the models that are presented in these modern mainstream textbooks try to describe and analyze complex and heterogeneous real economies with a single rational-expectations-robot-imitation-representative-agent.

That is, with something that has absolutely nothing to do with reality. ...

For almost forty years mainstream economics itself has lived with a theorem that shows the impossibility of extending the microanalysis of consumer behaviour to the macro level (unless making patently and admittedly insane assumptions). Still after all these years pretending in their textbooks that this theorem does not exist — none of the textbooks I investigated even mention the existence of the Sonnenschein-Mantel-Debreu theorem — is really outrageous.

|

| Image credit |

|

| Image credit |

|

| Image credit |

|

| Image credit |

|

| Image credit |

[L]et me clear up one extremely common and dangerous misconception. Socialism is NOT about taxpayer money providing social services like the Fire Department, or roads, or medical care, or the Post Office, or the military, or public parks, or the Police, or piped water. Those are all services, and all governments of all types provide a greater or lesser range of services. That’s the basic reason that we have governments.Socialism, on the other hand, has nothing to do with the provision of services. It is an economic system where the government owns the means of production of wealth—in Socialism the government owns the farms, fishing boats, and factories.So please, don’t be claiming that the northern European countries are socialist. They are not, because those European governments do NOT own the farms, fishing boats, and factories. Those countries may provide a wider range of taxpayer-paid services than the US or other countries provide … but that does NOT magically make their capitalist economies into socialist economies. Quite the opposite. Their successful capitalist economies are the reason that they can afford to provide those services …

|

| Image credit |

|

| Image credit |

|

| Image credit |

|

| Image credit |

You already know your customers, how to cooperate with them and what you can offer. Now the question is how you can reach your customers. There are many ways to reach customers using conventional (direct marketing: emails, calls, offline ads, etc.) or modern marketing methods (online marketing: website + SEO, online advertising, SMM, etc.).

Then you need to determine your pricing model. Translators and agencies use different pricing models with most common being per word, per page and per hour models. Choose what suits your needs better. You may use this translator rates calculator by Proz.Then set up realistic annual revenue rate. Calculate how much you need to cover your living expenses and find out how much will remain as net profit. Conduct a market research to find out the prices of your competitor to avoid charging too much or too low for your services.Now you have a customized business model ready for your freelance translation business. But remember, your business model is not a rigid framework, it is a dynamically forming and developing concept that can and should be adjusted depending on current conditions. Keep on experimenting: try to cover new markets, offer better services, use new technologies, and reach new heights!